Photos: Are you ready for higher interest rates?

BUSINESS LOANS -- Interest rates on bank loans to businesses usually are set based on banks’ “prime” lending rate, which is the rate charged to the most creditworthy borrowers. The prime rate has been 3.25% since late 2008. The prime always rises in tandem with the Federal Reserve’s short-term rate. So if the Fed initially raises its rate 0.25 percentage point, the prime will instantly rise to 3.50%. Rates on all loans pegged to the prime will rise by the same amount.

(PhotoAlto / Getty Images)

CREDIT CARDS -- Plastic debt typically is the most expensive debt, and the cost of carrying a balance on your card will rise with every Federal Reserve rate hike. That’s because most cards have floating interest rates, often pegged to banks’ prime lending rate. The average card rate now is about 15%, according to Creditcards.com. Your best defense against rising interest costs: pay down your card debt.

(Zoonar RF / Getty Images)

CAR LOANS -- Zero-percent car loans have long been a staple for car companies, with their own cost of money so cheap. But those loans often are hard to get for all but the most creditworthy borrowers, and that may become more true if the Federal Reserve begins raising rates. The good news: Most outstanding car loans are fixed-rate loans, which means their rate won’t change even if market rates head higher. But check your contract to be sure.

(Paul J. Richards / AFP/Getty Images)

STUDENT LOANS -- Students and parents with outstanding federal education loans won’t be hurt by Federal Reserve rate hikes because federal loan rates stay fixed for the life of the loan. Between now and July 1, 2016, new undergraduate federal loans will cost 4.29%. But because the rate for new loans is reset each July 1 -- pegged to the 10-year U.S. Treasury yield -- if long-term interest rates rise, future student loans will cost more. Private student loans, meanwhile, often have floating rates tied to the prime rate.

(Michael Jung / Getty Images)Advertisement

MORTGAGES -- Rates on 30-year mortgages take their cue from long-term government bond yields rather than short-term rates. And while long rates can move up in tandem with short rates, long rates also can go their own way. Long-term rates have risen this year, in part anticipating Federal Reserve rate hikes. The average 30-year mortgage rate now is 4.08%, up from 3.6% in January. If bond investors believe the economy will continue to improve, it’s conceivable that mortgage rates will continue to edge up.

(Steve Helber / Associated Press)

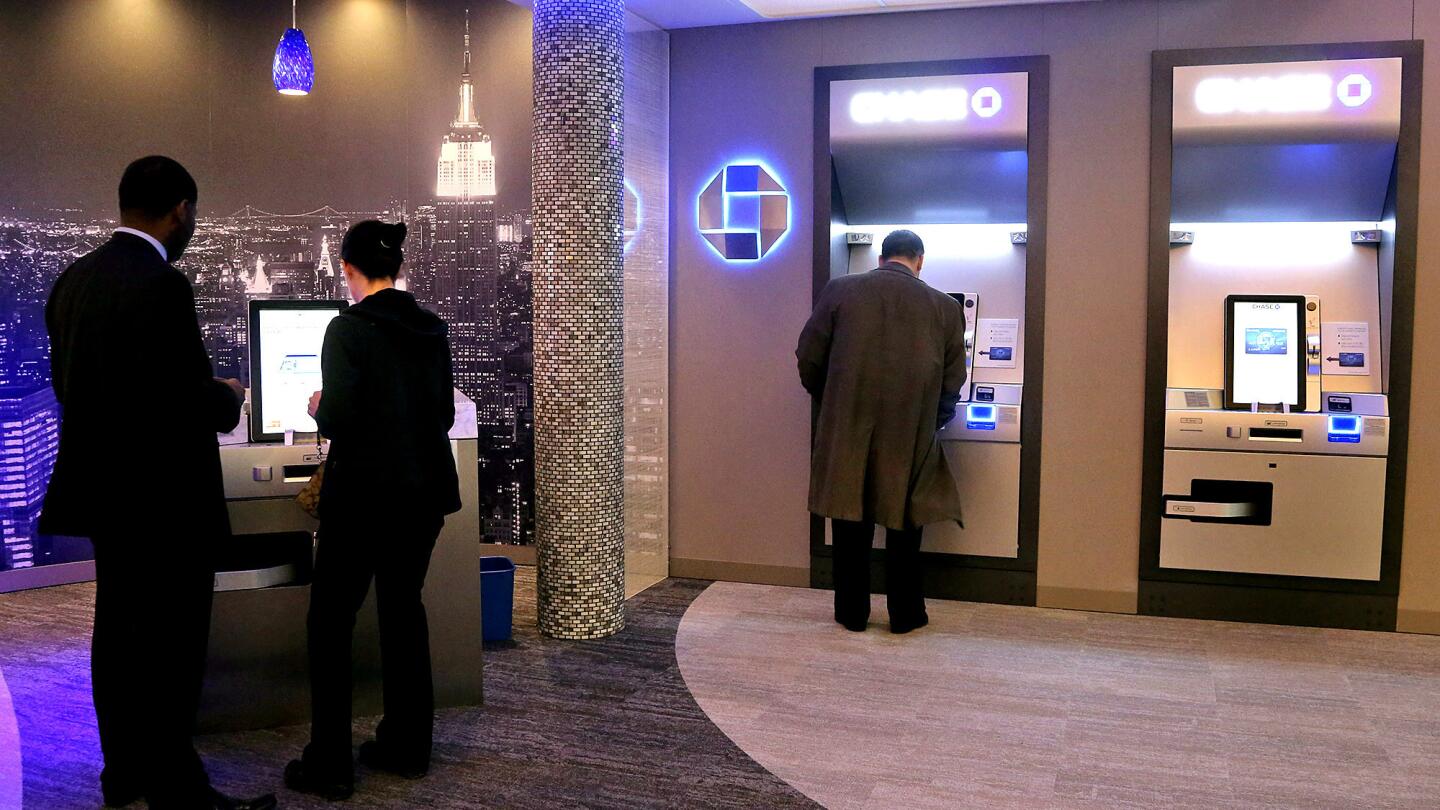

SAVINGS -- One sure winner with rising interest rates will be long-suffering savers. Banks have kept rates on most savings accounts near zero since 2008, mirroring the Federal Reserve’s key rate. The average one-year CD now pays just 0.27%, according to Bankrate.com. The average money market mutual fund pays a minuscule 0.01%. If the Fed starts lifting rates savings rates should rise. But analysts note that banks typically are slow to boost deposit rates.

(Mary Altaffer / Associated Press)

Fees can put a serious dent on your 401(k) retirement investments. (Spencer Platt / Getty Images)

BONDS -- Investors have flocked to bonds since 2008, in part for safety. But if longer-term interest rates rise in tandem with any Federal Reserve increases in short-term rates, bond owners will be hurt, at least on paper. That’s because older bonds paying fixed rates would lose value if new bonds pay higher rates. That has already happened this year, as the benchmark 10-year Treasury note yield has risen to 2.38% from 1.64% in February. Experts advise investors to look at their bond holdings and get a sense of how much risk their principal faces from rising rates.

(Chip Somodevilla / Getty Images)Advertisement

FOREIGN MARKETS -- Most foreign stock and bond markets aren’t directly affected by Federal Reserve interest rate changes, but the indirect effects can be huge. While the Fed is poised to raise rates, however, central banks in much of the rest of the world -- including Europe, Japan and China -- show no sign of following suit. Some investment pros say that could provide an advantage for foreign stock and bond markets compared with U.S. markets. But rates are just one variable in determining market performance.

(Vanderlei Almeida / AFP/Getty Images)

CURRENCIES -- A nation with rising interest rates often has a strong currency. That’s because higher rates attract global investors and boost demand for the currency. The dollar has already become the strongman of world currencies over the last 12 months. If the Federal Reserve raises short-term rates, the greenback could get even stronger. That would be great for U.S. tourists abroad -- but bad for U.S. businesses that export, because it would make their products more expensive abroad.

(Ulrich Baumgarten / Getty Images)